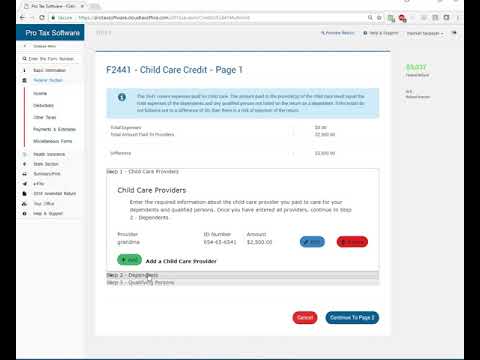

We're going to talk now about dependent care expenses form number 24 or 41, and it's a pretty straightforward form. There are phase-out provisions as it relates to this, and it wouldn't really apply to some, but for most people, it absolutely does help. So, we're going to go ahead and click "Add" the provider's name. We're going to say that this was paid to an individual. If you paid it to an institution or a middle school of some kind, go ahead and click on the EIN. The provider's last name was "Grandma," and her first name was "Miranda." The address was 33016, keeping everything in Florida. The amounts paid to the provider for child care, not paid to the provider for child care, will be $2500. We're going to continue, and now we need to allocate this expense to the dependents who they were paid for. This guy got $2000 worth of the $2500, and this gal only had $500 worth of that. So, we could continue, and that's more or less it. This is not really commonly used to where people go in and start drilling down into these additional sections. The mainstay of the form is to put in the care provider information and then allocate those expenses between the two dependents in order for it to then apply. If you had more than one care provider, which you would aggregate those on that form, you would add the additional care provider here and then again split it amongst the dependents. Explicit dollar amount is paid to each of the providers, so it's a little bit different than the other forms where we would add outside the form. Another instance of the form, there is only one that gets attached to the return, and you put...

Award-winning PDF software

2441 instructions 2025 Form: What You Should Know

You do not need to calculate the total for the month). You do not need to calculate the total for the month). Form 2441: Child and Dependent Care Expenses Note that child care expenses you pay on behalf of a dependent will be includible in your income subject to the 10% limitation. Here's a sample example of how to calculate child care expenses from the child's monthly spending breakdowns for 2017. Monthly Expense Breakdown Date Spending Example Monthly Expense Total For Child January 4,000.00 16,500.00 28,750.00 January Child Care 1 February 4,000.00 16,000.00 28,500.00 February Care 1 March 4,000.00 16,000.00 28,500.00 March Care 1 April 4,000.00 16,000.00 28,500.00 April Care 1 May 4,000.00 16,000.00 28,500.00 May Care 1 June 4,000.00 16,000.00 28,500.00 June Care 1 July 4,000.00 16,000.00 28,500.00 July Care 1 August 4,000.00 16,000.00 28,500.00 August Care 1 September 4,000.00 16,000.00 28,500.00 September Care 1 October 4,000.00 16,000.00 28,500.00 October Care 1 The following amounts may help you with your monthly expenses. Example: Month 1 3,000.00 12,000.00 28,625.00 Month 1 expenses will also include health insurance costs of the person getting care. Monthly Expenses Breakdown Date Spending Examples Monthly Expense Total For Person 2 30,450.00 150,000.00 336,375.00 Person 2 Care 1 3 30,450.00 150,000.00 336,375.00 Person 2 Care 2 4 30,450.00 150,000.00 336,375.00 Person 2 Care 3 5 30,450.00 150,000.00 336,375.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Instructions 2441, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Instructions 2441 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Instructions 2441 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Instructions 2441 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2441 instructions 2025