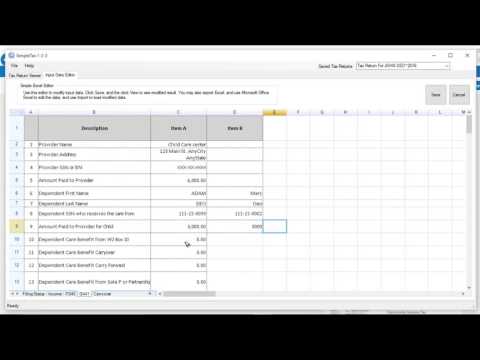

Welcome to Simple Tax! One, two, three... Child Dependent Care Credit. Using Form 2441, first create a basic tax return with a married couple and two qualified children. Your dependent children must meet the qualifications to claim the Dependent Care Credit. You will then need to enter the second child's name, social relationship, etc. After that, go to the menu and add an optional schedule or forms. Click on Form 2441 and click "Apply Now." Click the "Edit" button to enter data for Form 2441. For example, enter $6,000 paid to the childcare provider. Assume both children are in the same provider facility. For each child, enter $3,000 dollars respectively. If you have a childcare benefit program which allows you to put $5,000 for childcare, enter the amount from W-2 line 10 here. When done, click the "Save" button. Click "Import" to enter W-2 income. For example, enter $70,000 for the primary taxpayer. To qualify for a Dependent Care Credit, it is required that both spouses have earned income, so import W-2 income for the spouse as well. Now click the "View" button to see the result. The Form 2441 is generated. The expense of $6,000 is paid to the provider. Because you have a dependent care benefit, Part 3 must be completed. Complete lines 27 to 31 to determine the amount for the childcare credit. Because you have two children and can have a $6,000 credit, but $5,000 of them are used by the dependent care benefit, only $1,000 can be used for the credit. Complete Part 2 to calculate the credit based on your total income. You can only take 20% of $1,000, which is $200. On Form 1040, enter the child care expense credit at line 49. Thanks for watching.

Award-winning PDF software

2441 2025 Form: What You Should Know

Form 2441 will be mailed to all taxpayers by the deadline and tax form preparation should be completed in advance of the deadline. Form 2441 should be mailed to: Treasury Operations Center Internal Revenue Service. P.O. Box 204925 Atlanta, GA 30 United States (see the Form 2441 Instructions for tips to mail forms). Send Forms 2441, Form 2555, Form 5601, or Form 5715 If you are a non-U.S. resident citizen, you can send your form 2441 to: Form 2441 The U.S. Citizenship and Immigration Services P.O. Box 113507 Washington, DC 20 This form requires the U.S. citizen to complete all information required on the form. Form 2350: Tax on the Care of Children in a Foreign Country — A Foreign Tax Credit Jul 16, 2021– Form 2350, Tax on the Care of Children in a Foreign Country — A Foreign Tax Credit, and information about a special credit, is now effective. Form 2350 can be filed in both the United States and a foreign country. It provides a foreign tax credit for a portion of the cost of care of dependents (that is, dependent children of citizens of the United States and foreign citizens of countries with which the United States has tax treaty arrangements). A foreign tax credit is computed. If you pay a foreign tax deduction for care of your dependents, you have a foreign tax credit. Note: If you're going to use the credit to offset other tax expenses, please consider the following: You may not have to file a return. You may only use the credit for medical expenses for the care of your dependents with a foreign tax home. If you pay your U.S. taxes by check or other payments, you can't use the credit. Only tax professionals can get a foreign tax home. You need to have all of your filing information for the tax year in order to work out your foreign tax credit. If more than one taxpayer pays any taxes incurred under the tax treaty arrangement, the taxpayer that paid the total amount of taxes due on the U.S. side of the tax treaty arrangement receives the foreign tax credit. Do you pay taxes by check, credit card, or other payment method? Yes.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Instructions 2441, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Instructions 2441 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Instructions 2441 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Instructions 2441 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 2441 form 2025